Extreme energy, infrastructure, and markets

Executive Summary

By Hernán Scandizzo

Copyediting and translation: Nancy Viviana Piñeiro

The gas and oil extracted from unconventional formations make up an ever-increasing percentage of Argentina’s hydrocarbon production. Although in the second half of 2018 the Government authorized gas exports again, this does not mean that the country has achieved self-sufficiency and is selling its surplus, rather, it is related to a lack of transport and storage infrastructure, the exporting vocation of its authorities and the need to keep activeeven in the hot months when consumption fallsone of the few sectors that retains a high dynamism despite the economic recession plaguing the country.

In this report, the Observatorio Petrolero Sur seeks to put forward different paths around Vaca Muerta (Dead Cow). What it means for Argentina is one of the central questions; others are how this megaproject is inserted in the regional gas market and what role large companies play in this highly transnationalized sector of the Argentine economyespecially Shell, one of the main actors in the global gas trade.

-

What does Vaca Muerta mean for Argentina?

“The proven reserves in the Vaca Muerta field, added to those of the the San Jorge and Austral Magallanes basins, are in the order of 27 billion barrels of oil and 802 TCF (trillion cubic feet) of gas, where more than 80% correspond to Vaca Muerta (…) Those volumes imply not only that Argentina would achieving self-sufficiency, but that it would also become an exporting and price-setting country”. Such is the horizon of abundance projected in the third report of the Strategic Studies for the Territorial Development of the Vaca Muerta Region, prepared by the national Government and the provinces of Neuquén, Río Negro, La Pampa, and Mendoza, which make up the Vaca Muerta Region.1 The document was published in February 2016, right after Mauricio Macri took over the presidency. However, the work had been done during Cristina Fernández de Kirchner’s second term (2011-2015). Perhaps the greatest point of agreement between both governments in their vision of the country is the centrality of unconventional fields exploitation in particular Vaca Muertato boost Argentina’s economy. The differences arise in who should drive and set the course of the megaproject and how to distribute its economic benefits. Both administrations even maintained subsidy schemeswith some differencesto promote gas production from unconventional fields.2

The province of Neuquén concentrates the largest number of unconventional projects, just over thirty, although at the time of writing this report only a handful had entered the massive development phase.3 Meanwhile, in Río Negro, the high productivity of tight sand gas in the Estación Fernández Oro field pushes the extractive frontier in an area with a long history of fruit growing. Other projects in exploratory stage are added to the list. In the province of Mendoza, some pilot projects are advancing on the Vaca Muerta formation, while almost at the southern tip of the country, the high performance of a massive tight gas development in the Campo Indio area, in the province of Santa Cruz, exhibits the unconventional potential of the Austral Basin. According to data from the Ministry of Energy, in the period October 2017/October 2018, the production of shale gas in Vaca Muerta increased by 243%; the rise for shale oil was 70%. Together, the unconventional fields, that is, the shale and tight sands of the Neuquén and Austral basins, contributed 38% of the gas and 15% of the crude oil extracted from all the productive basins in the month of October 2018.

However, in spite of the seemingly spectacular data, unconventional exploitation is still in the initial phase and investments do not reach the country in the magnitude expected by the national and provincial authorities. In fact, the majority of large oil companies’ projects are still in pilot stage with only a dozen wells in production. In this context, the main drawback for them and the Government is the lack of infrastructure that allows extracted gas to reach the national, regional and global markets with a competitive price, given that achieving the established goals requires building new pipelines that will increase transport capacity, as well as storage structures and export port terminals. Even import substitution of gas from Bolivia and LNG necessarily implies increasing transport capacity in existing sections and building new lines that reach other regions of the country.

The Argentine authorities’ bet on Vaca Muerta as the driver of the national economy was became clear when the country held the G20 presidency (December 2017 to December 2018), where they insisted with a discourse that positions gas as a bridge fuel and raised the need to strengthen the global market. In June 2018, at the G20 Ministerial meeting on Energy, the Secretary of the US Department of Energy, Rick Perry, offered technical assistance to Argentina to build the infrastructure that Vaca Muerta needs, specifically attracting pipeline developers and petrochemical companies.

However, beyond the stubborn optimism of the Vaca Muerta consensus at the domestic level and the endorsements obtained as part of the G20 meeting, the great Argentine promise was also strongly questioned. In October 2018, the United Nations Committee on Economic, Social and Cultural Rights (CESCR) expressed concern about the contributions to climate change and the potential negative environmental impacts of oil and gas extraction from Vaca Muerta. Shortly before, the Intergovernmental Panel on Climate Change had issued a new report on the need to take urgent measures to avoid serious global warming.4

-

Infrastructure

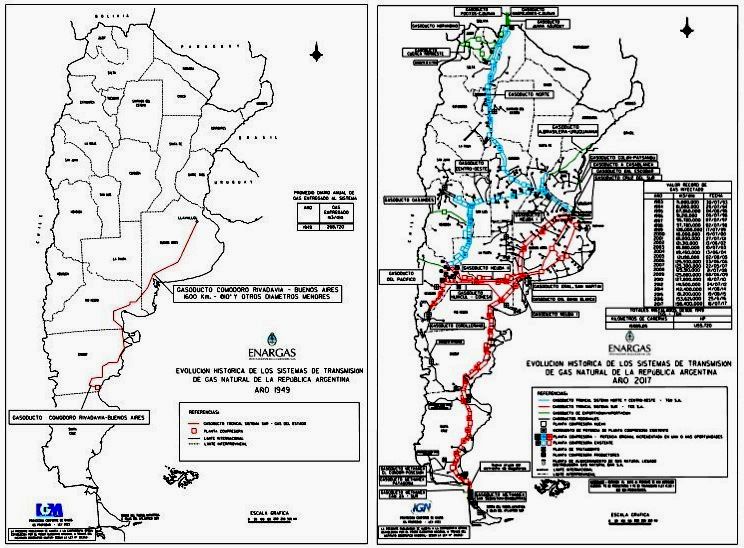

The network of gas pipelines that crosses the country and links the fields with the large consumption centers and the regional market began to be laid out towards the end of the first half of the 20th century. In 1949, the Comodoro Rivadavia (Chubut)-Llavallol (Buenos Aires) gas pipeline, of 1,600 kilometers, was inaugurated. By then it was the most extensive one in the world. The southern backbone of the pipeline positioned Argentina at the forefront of gas utilization, along with the two main world powers of that time, the Soviet Union and the United States.

In the following years, the South trunk went deeper into the Patagonia region, both in the San Jorge Gulf and the Neuquén basins. While in 1965 transport began from the fields in the province of Salta, north of the country, through the Campo Durán (Salta)-Gral. Pacheco (Buenos Aires) north gas pipeline, which structured the Gasoducto Troncal Sistema Norte. Shortly afterwards, the north section began to receive fluid from Bolivian fields through the Madrejones-Campo Durán and Pocitos-Campo Durán cross-border lines.

In the 1970s, the southern section was also extended, which linked the southern fields of Santa Cruz and Tierra del Fuego with the great consumption centers of Buenos Aires. In the early 1980s, the Centro Oeste gas pipeline was inaugurated, which transports the production of Mendoza and Neuquén to the province of Santa Fe (central region).

In 1988, the Neuba II Gas Pipeline launched operations from Neuquén to Buenos Aires. Both this gas pipeline and the Centro Oeste section were laid to transport the production of the Loma La Lata (Neuquén) mega-field, which was discovered in 1977 and became a landmark in the country’s energy history. By 1973, according to data from the Ministry of Energy, oil represented 69% of primary sources, while natural gas accounted for 22%. The production start-up of Loma La Lata increased the share of hydrocarbons as a primary source and changed the gas/oil ratio. Currently, gas represents about 45-50% of primary sources, and oil accounts for 30-35%5

Just as the discovery of Loma La Lata and other fields in the Neuquén Basin underpinned the gasification of the Argentine energy matrix, the neoliberal reform of the State towards the end of the 1980s and the privatization of the companies Yacimientos Petrolíferos Fiscales y Gas del Estado meant that the production and expansion of gas transportation networks were projected to respond to market logics rather than to a regional energy integration. Chile and Argentina signed the Gas Interconnection Protocol in 1995, signed by presidents Eduardo Frei Ruiz-Tagle and Carlos Menem, setting the norms that the companies participating in the market had to observe.6 In early 1996 Argentina and Brazil signed a Memorandum of Understanding on Energy Cooperation and Interconnection, which contemplated the export of gas from Entre Ríos to Uruguayana through a gas pipeline (Aldea Brasilera-Uruguayana) that was built and started operations in 2000. Also during those years, bilateral negotiations and agreements with Uruguay moved forward,7 and by the end of the decade, in December 1999, the Memorandum of Understanding Concerning Gas Exchanges and Gas Integration between Mercosur State Parties. By then, most of the export pipelines from Argentina were already in operation or approaching completion.

In spite of this, the accelerated exploitation of the Neuquén fields and the failure to incorporate new reserves to the market made the upward curve in gas production reach its peak in 2004. Also, by 2007 Argentina closed its exports to Chile and increased the import of gas from Bolivia.8 In June 2008, a regasification vessel began operating in the port of Bahía Blanca, in the southern part of Buenos Aires. Three years later, the gas import capacity was expanded with another vessel in the port of Escobar, in the north of Buenos Aires. In later years, the gas pipelines that had been used for export changed the direction of flow to import gas from Chile, as is the case of NorAndino and GasAndes.

Vaca Muerta, running on the remains of Loma La Lata

When the unconventional potential of the Neuquén Basin began to be promoted in the early years of the 2010s, the existing hydrocarbon infrastructure and the availability of skilled labor were outstanding featuresa substantial comparative difference with other formations that only had potential resources. Although the installed capacity of the gas sector, inherited from the splendor of Loma La Lata, was an objective advantage, it was not enough to guarantee the infrastructure needed for Vaca Muerta. First this became evident in the face of the business sector’s urgency to reduce production costs and secure the viability of massive developments. There was (and still is) a need for roadworks, aqueducts, repair and extension of railway branches, construction of frac sand collection and conditioning centers and oil waste treatment plants.9 And to that list a new bottleneck was addedthe lack of infrastructure to inject into the market the rising gas and oil flows. If access to the market is not guaranteed, the potential of unconventional formations itself is not reason enough for the “rain of investments” (as president Macri calls them) that the meteorologists of Vaca Muerta regularly announce. The large companies that recognized the need to raise their flag on the Neuquén Basin because of the potential of that play already did it.10

In July 2015, the Argentine Institute of Oil and Gas (IAPG), headed by companies in the sector, published the report From Vaca Muerta to the Homes of Argentinians, consisting of an assessment of the existing gas infrastructure and that which is necessary to place on the market the gas housed in shale and tight sand formations in northern Patagonia. Back then, the institution warned of the need to expand the transportation capacity of the main gas pipelines with the country’s major consumption centers: “Such an ambitious development of the gas industry presupposes that all existing gas transportation infrastructure will be put to use again with high levels of demand in the medium term. Old gas pipelines and compressor plants will require significant investments to ensure the sustainability of the system.” The report also highlighted that “42% of gas pipelines and 17% of compressor plants owned by TGN [Transportadora Gas del Norte]11 and TGS [Transportadora Gas del Sur]12 are over 40 years old.”13

On the other hand, taking into account the fall in gas consumption during the warm months and so as not to affect production, the IAPG proposed the export of this differential to neighboring countries, making use of the available infrastructure of international pipelines. They also proposed as an alternative the underground storage of gas and the construction of offshore tanks in local or foreign regasification ports. Two years after that report was published, the Argentine government authorized the export of gas from the Austral and Neuquén basins, and the operators Pluspetrol and YPF plan to store gas in wells that are out of production. More than thirty gas export permits were approved since July 2018 at the close of this report. While Chile is the main destination, the others are Brazil and Uruguay. Total Austral, Pan American Energy, Wintershall, ExxonMobil, YPF, Pluspetrol, and General Fuel Company are among the companies that already sell gas beyond national borders.

Furthermore, in addition to expanding the transportation capacity of the gas pipeline system, converting Vaca Muerta gas into liquid would allow production to go beyond the national and regional markets and be injected anywhere in the world where there is a regasification port. In fact, the liquefaction process resolves the “physical” limit, since inserting that gas into the world market depends on other variables, such as costs, supply, demand.

Below there is a brief list of the existing and projected infrastructure to insert Vaca Muerta into the gas market.

• Vaca Muerta Pipeline. In June 2018, an agreement was signed between the government of Neuquén and the company TGS for the construction of a 130 km collection gas pipeline and a gas conditioning plant in the Tratayén site, for subsequent injection into the pipelines Centro Oeste (TGN’s), and Neuba II (TGS’s). This pipeline would directly benefit companies such as Shell, Total Austral, Exxon Mobil, Dow Chemical, Pluspetrol, YPF, and Pampa Energía. The initial work requires an investment of USD 300 million and could reach USD 800 million, as new blocks start production and their expansion becomes necessary.

• Pacific Gas Pipeline. Inaugurated in 1999, it originally linked the mega-site Loma La Lata with the Chilean region of Bío Bío. In 2005 it was converted for transport inside the Argentine territory. With the launch of unconventional exploitation, it began to evacuate the production of YPF, Total, Shell, Exxon Mobil, and Tecpetrol fields, and quickly completed its transport capacity. Gasoducto del Pacífico SA (Argentina)14 is aimed to go from 7.5 million m3 per day to 12.5 million. That five million cubic meter increase in transport capacity was awarded in an open tender to YPF and Exxon Mobil until October 2030.

• Rosario gas pipeline. In the last quarter of 2018, the construction of a new trunk was announcedit would begin at the Tratayén gas conditioning plant, located in one of the most productive areas of Vaca Muerta (in Neuquén), toward the south of Buenos Aires, and would enhance the activity of the most important petrochemical pole in the country. From there it would continue to the north of Buenos Aires and the province of Santa Fe, to supply the industrial hubs of San Nicolás and Rosariothe latter is one of the world’s leading soybean processing centers. By connecting to the TGN system, it could also transport gas to the Argentine northwest and begin to replace imports from Bolivia. The pipeline will have a transport capacity of 25 million m3/day and is expected to expand to 40 million m3/day in a second stage.

Liquefaction Plant In 2016, the Argentine government began to probe the possibilitythrough the Empresa Nacional de Energía SA (Enarsa), which later became IEASAfor a liquefaction vessel to operate in the port of Bahía Blanca, 650 km south of the City of Buenos Aires. The project did not prosper but the issue remained on the agenda. In October 2018, YPF signed an agreement with the Belgian company Exmar for the installation and operation of the Tango FLNG liquefaction vessel, which will allow small volumes of gas to be transported by ship. On the long term, and depending on the development of Vaca Muerta, YPF’s aim is to build an onshore liquefaction plant. On the other hand, TGS signed an agreement with the US company Excelerate Energy LP to evaluate the feasibility of the construction of a liquefaction plant, also in Bahía Blanca.

Underground storage facilities. The possibility of storing surplus production in times of lower consumption, as is the summer, is a variable that different companies evaluate. One of the alternatives is the use of fields that have already been exploited, another is liquefaction and storage in methane vessels. In Vaca Muerta, the two main producers of gas from unconventional deposits, YPF and Tecpetrol, work on an underground storage project at the Los Bastos field, near the city of Plaza Huincul, located 120 km from Neuquén capital.15

-

Regional gas trade and Shell’s strategy

Consolidating its leadership in the gas market and positioning itself on mega-reservoirs were objectives that Shell pursued in the last decade in Latin America and the Caribbean, and it managed to cement its position in strategic points of the region. With the purchase of LNG assets from the Spanish oil company Repsol in 2013 and then, by absorbing BG in 2016other leading company in gas production, transport and marketingthe Anglo-Dutch company acquired a majority share in the Atlantic LNG liquefaction plant (Trinidad and Tobago), the sixth largest LNG exporter in the world. Furthermore, in 2017 it bought the assets of the Trinidadian subsidiary of Chevron Corp, which gave it a presence on the mega offshore field Loran Manatee.

Also from the purchase of Repsol’s assets in 2013, Shell obtained control of 20% of Peru LNG, owner of Pampa Melchorita, the first liquefaction plant in South America. Thus, Shell managed to strategically locate itself in the two countries of the region that have the ability to inject its gas production into the world market. Just as the Anglo-Dutch company returned to Peru with the purchase of Repsol’s assets, the same happened in the case of Bolivia in 2016, but after the purchase of BG.

Also after the purchase of BG, Shell became the main supplier of liquefied natural gas in Chile. The company had the same relevance in LNG trade in 2017 in Argentinait was responsible for 22 shipments out of 68 that the State bought that year through Enarsa, compared to the previous year, when it only shipped 8 out of 76 at the country’s regasification ports. This growing participation of the company in the sale of LNG, and also diesel, led to criminal complaints for violation of the Public Ethics Law16 and the Procurement Regime17, as those presented by the national senator Fernando Solanas against the then Minister of Energy and Mining, Juan José Aranguren. Up to six months before assuming public service, Aranguren had been CEO of Shell Compañía Argentina de Petróleo SA, and as head of the Energy portfolio he continued to hold shares of Royal Dutch Shell plc.18 In that period, Shell Western Supply obtained seven of the eight tenders for gasoil shipment contracts that were signed in the country. The import of gas from Chile was also authorized, a resource that the Chilean oil company ENAP bought from BG and sold to Enarsa at a price 53% higher than that of the LNG reaching Argentine ports back then.19

Even so, the most significant feature about Shell in Argentina has not been the sale of LNG and diesel but its return to exploration and production activities in Vaca Muerta, a segment in which it had little presence in the country since the 1970s, when it focused on refining and marketing. In addition to accumulating areas in the province of Neuquén to access the shale formation, the company launched a restructuring process by selling some of its assets in the refining and marketing segments, which it sold to the Brazilian company Raízen –50% of which is controlled by Dutch Royal Shell plc–, to focus on the upstream segment. The interest goes even beyond Vaca Muerta, as is clear from the pleasure with which the Anglo-Dutch oil company received last October the news about the opening of the bidding round of 38 offshore areas in the Argentine Sea. “We are seeing how attractive the tender is and I suspect there will be interest. Different countries in Latin America have been very active during the last five years in offshore areas, such as Colombia and Brazil, so hopefully Argentina receives a bit of this resurgence,” said Wael Sawan, executive vice president of Aguas Profundas.20

Vaca Muerta is characterized by the mega potential of gas that the US Energy Information Administration has awarded it in successive reports. Despite this, Shell focused on the production of shale oil in the Sierras Blancas, Cruz de Lorena and Coirón Amargo Sur Oeste areas. In early 2018, it announced investments with the goal of extracting 40,000 barrels per day by 2021at that time it did not exceed 12,000. However, the decision to focus on oil does not imply being excluded from a gas market that is energized from the exploitation of tight deposits. The Argentine government reopened gas exports, and at the conclusion of this report, 28 permits had been approved, three of them obtained by BG Chile.21 This reopening is too recent and tied to the ups and downs of production in Vaca Muerta, but in spite of this the company is securing its share. Even when the first pilot projects for extraction through fracking were being launched, the emergence of Vaca Muerta and the possibility that important volumes of gas would once again reach Uruguayan networks from Patagonia had an impact on the country’s government decision of building a regasification port near Montevideo. In 2017 the proposal was rescued with some modifications. The construction of a smaller-scale port was proposed, Shell became interested and signed a memorandum of understanding, but in April 2018 the Uruguayan authorities decided not to renew the agreement due to the lack of company definitions to finalize the investment. The viability of the works depended on a considerable fraction of the regasified gas being injected into Argentine networks and that is not secured.22

While the reorientation of Shell’s investments in Argentina from Vaca Muerta, at the Latin American and Caribbean level is significant, as can be seen in the Shell Global corporate portal, the highest expectations are deposited in Brazil’s deepwater deposits more than in the potential of shale and tight sand reservoirs in northern Patagonia. After the institutional coup that overthrew Dilma Rousseff in 2017, the company was one of the most benefited by the policies implemented by the de facto government of Michel Temer, which facilitated the entry of private oil companies to the pre-salt, allowing Shell to become the main private operator in the country. The advance of the Anglo-Dutch company towards the offshore deposits characterizes its current global strategy, and in the region it is expressed not only in its dominant presence in the pre-salt but also in the blocks that the company was awarded in the Colombian Caribbean, in the exploratory campaign developed off the Uruguayan coast,23 and in the possibility of gaining offshore exploration permits in Argentina and Peru.

—

1Ministry of the Interior, Public Works and Housing, Strategic Studies …, pp. 123 and 124.

2From the outset, unconventional activity was linked to the injection of direct or indirect subsidies. Any variation in that scheme is immediately reflected in production volumes and employment levels. More detailed information on the differences of both administrations around Vaca Muerta can be found in the following EJES reports: Ganadores y Perdedores en la Argentina de los hidrocarburos no convencionales (2017), Transferencias al sector hidrocarburífero en Argentina (2018) and La exportación y el desplazo de YPF (2018).

3More information on the evolution of projects in Vaca Muerta on the government website Argentina.gob.ar

4CESCR, Concluding Observations …, pp. 3, 11.

5In the 1970s, Neuquén began its gradual conversion into an energy-generating province for the Pampa Húmeda region. To the start-up of the Chocón-Cerros Colorados hydroelectric complex was added the discovery of the Puesto Hernández (1969) and Loma La Lata fields, which increased the country’s oil and gas availability and gave a higher status to the sector in the province’s economy. By 1990, the importance of these resources was consolidated, not only by the growth of gas and oil reserves from new discoveriesEl Portón (1990), El Trapial (1991) and Sierra Chata (1993) but also by the increase of exports and payment of royalties, which had a strong impact on the provincial budget.

6After its signature, nine export pipelines to Chile were built: GasAndes and Methanex San Sebastián-Bandurrias (Methanex PAE), operational since 1997; Methanex El Cóndor-Posesión (known as Methanex YPF) and Methanex Patagonia (known as Methanex SIP), operational as of 1998; Atacama, Norandino and Pacífico, operational since 1999; and Methanex EGS and Methanex CAM 2A Sur, operational as of 2005. Five pipelines cross the border to supply the Canadian firm Methanex, located in Cabo Negro, Magallanes Region. This company, based in Vancouver, is one of the largest producers and suppliers of methanol worldwide, and has production plants in Canada, Chile, Egypt, New Zealand, the United States, and Trinidad and Tobago.

7After the agreement, three export pipelines to Uruguay were built: Colón-Paysandú, operational as of 1998; Cruz del Sur, operational as of 2002; Casablanca, completed in 2000 and operational since 2012. Gasoducto Cruz del Sur SA has the concession of the Cruz del Sur and Casablanca gas pipelines. This corporation is controlled by BG Group, Pan American Energy, ANCAP, and Wintershall.

8Further information on this can be found in De Dicco (2006), Estudio sobre el agotamiento de las reservas hidrocarburíferas de Argentina, período 1980-2005.

9Even more deficient was the social infrastructure, which is evident in Añelo, a city that became the beachhead of unconventional activity overnight. In 2014, shortly after being promoted as the National Capital of Shale, it collapsed in all orders: housing, education, health, roads, services light, gas, water, sewage; thousands of men and, to a lesser extent women, suddenly arrived to the promised land. For further information check the report Megaproyecto Vaca Muerta. Informe de externalidades, published in March 2017.

1010 See report European companies set to conquer Vaca Muerta, OPSur, October 2018.

11The controlling shareholders of Transportadora de Gas del Norte (TGN) are Gasinvest (56%) – a company formed by Tecpetrol Internacional SL, Compañía General de Combustibles SA and RPM Gas SA – Southern Cone Energy Holding Company Inc. (24%) and the Buenos Aires Stock Exchange (20%). (TGN, n.d).

12The main shareholder of Transportadora de Gas del Sur (TGS) is Compañía de Inversiones de Energía SA (CIESA), which owns 51% of the share capital. The remaining percentage is listed on the Buenos Aires and New York Stock Exchanges.

13TGN and TGS control the main pipelines of the North and Central West, and South systems, respectively.

14The main shareholder of Gasoducto del Pacífico SA (Argentina) is the Compañía General de Electricidad, owned by the Spanish Gas Natural Fenosa, with 56.7% of the shares. The junior partners are YPF and Chilean oil company Enap y Trigas (BAE, 05/14/2018).

15Paradoxically, in that town the production of hydrocarbons in the Neuquén basin began after the discovery of oil in October 1918.

16Solanas argues that Aranguren, being an official, violated Article 12 of Law 25.188 on Public Ethics, since one of the firms he was a director of was the main winner of the purchase of diesel by the Administration he was part of. See Página/12, 11/09/2017.

17The senator says Aranguren violated the Contracting Regime by buying gas from Chile 128% more expensive than the price Bolivia sets for Argentina. Watch InfoSur, n/d, and Ministerio de Energía y Minería de la Nación, 06/14/2016.

18Ministerio de Energía y Minería de la Nación, 09/13/2016.

19La Nueva, 06/05/2016.

20La Nación, 10/17/2018.

21The Argentine government approved 34 gas export permits between August 28, 2018 and February 10, 201928 to Chile; three to Uruguay; and many others to Brazil (Ministry of Energy, n. d.).

22El Observador, 04/06/2018

23Since the purchase of BG, Shell obtained exploration rights in Uruguayan offshore blocks and shares in the company Gasoducto Cruz del Sur SA, with concessions for two of the three gas pipelines connecting Argentina and Uruguay.