Vaca Muerta is a leading case for the next generation of fossil fuels. Big Oil and Gas companies are keen to turn it into a success story —which is why we collectively need to put a stop to this if we are serious about restricting oil and gas supply globally, protecting territories and fighting climate change. It is our view that “Killing the Dead Cow”—and thus preventing a further expansion of the fossil fuel industry that would be a door-opener for further projects in the Global South— is necessary to build up pressure for an honest dialogue about “managed decline” and fair transition. The collective success of movements in an emblematic case like this would increase leverage for such a conversation.

Taller Ecologista and Observatorio Petrolero Sur in EJES, Argentina

February 2018

Briefing: Winners and losers in Argentina in the age of unconventional hydrocarbons. The alternatives scenario.

Corporations looking to invest have been pushing for better and safe conditions as part of their demands. One major step in this regard has been the modification of the regulatory framework, where a special economic regime has been set up to enable tax breaks and other incentives, including tailor-made labor reforms.

Moreover, through different programs designed by the national executive branch, economic incentives and transfers have been increasing, and will be kept in place in the medium term. Our research claims that, overall, between 2008 and 2016, the state contributed 16 billion dollars to companies in the sector, where economic transfers as a whole towards the industry added up to more than 21.5 billion dollars. For the companies, the impact is huge. By 2015, the economic transfers represented 48% of their annual turnover.

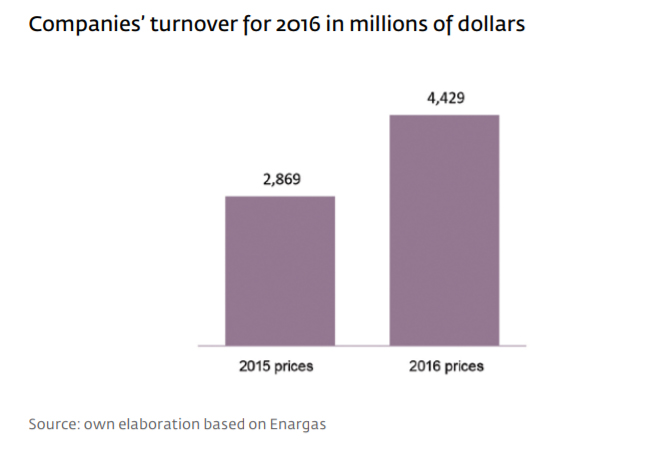

Since 2016, the main source for these resources has switched from being the State to consumers, as gasoline prices and energy bills have risen by up to 1000%. Thanks to the increase in the rates paid by different users (households, stores, industries), the hydrocarbon companies recorded an additional turnover of 1.559 billion dollars in 2016. The producers of hydrocarbons were not the only ones to benefit from higher prices; so did the intermediaries in the sector (carriers and distributors). An end to mandatory productive investment in 2016 as a condition for receiving incentives, has resulted that the companies earned more than in 2015, but they invested much less and fired over 3,000 workers.

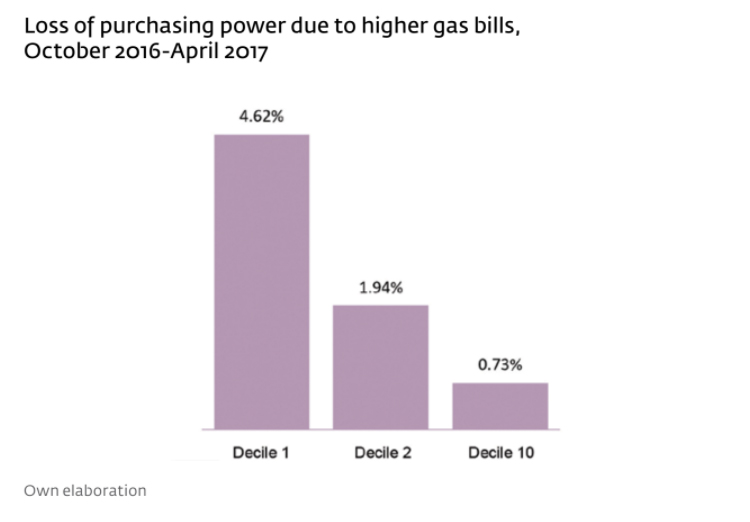

Among the biggest losers of this policies are households. If we take the population decile with the second lowest income, the proportion of income earmarked for the consumption of natural gas has more than doubled. Moreover, the impact of the massive rate hikes is entirely unequal. By April 2017, 10% of the poorest households spent almost 9% of their income on gas bills, while the wealthiest 10% of households earmarked little bit more than 1%.

This process has created greater concentration in the unconventional exploitation, rather than conventional one. Unconventional oil production increased from 5% of the total in 2015 to 7% in 2016, while unconventional gas production rose from 15% of total output in 2015 to 21% in 2016.

On the other hand, our research shows as well there are many different options and strategies with varying positive impacts that can be adopted on the path of transitioning to a more renewable matrix. For example, if different mechanisms were implemented (35% of users to implement water saving systems, 25% of users to implement hybrid solar systems for water heating, and the rest migrate to efficient class A water heating systems), we would manage to save nearly 30% of unconventional gas production. Smart solutions to address such consumption can yield big savings for a modest investment at the State level. This saving would be equivalent to 6.5 MM tCO2 less in emissions into the atmosphere.

The following briefing is a summary of three different reports published by Ejes between 2016 and 2017. The first focuses on subsidies and other economic transfers towards the hydrocarbon sector. The second updates these figures, expanding the research to the impact of tariffs in households and companies behavior, including the creation of offshore networks. The last lays out different energy scenarios based on transitioning unconventional gas, using both renewable energy and energy efficiency in households.

See also these other briefings and press releases on Vaca Muerta:

- BP’s Fracking Secrets: Pan-American Energy and Argentina’s shale mega-project

- UN Spotlight on Impacts of Argentina’s Vaca Muerta Fracking Project on Indigenous Rights and Climate Change

- ‘Heading South: The dash for unconventional fossil fuels in Argentina

There are 1 comments

Comments are closed.